The Ultimate Guide To Prf Insurance

Table of ContentsThe 8-Minute Rule for Prf InsuranceThe Single Strategy To Use For Prf InsuranceIndicators on Prf Insurance You Need To KnowOur Prf Insurance PDFsThe Facts About Prf Insurance Revealed

Jennifer is believing in advance about things such as waste contamination and also other possible contamination risks. If waste from her cattle infects a close-by body of water, Jennifer is legitimately in charge of the cleaning. She's likewise had a few close friends who have had injuries to their animals when they get stuck in stalls, so she wishes to take a look at insurance that guards her ranch versus the prices connected with entrapment.

Entrapment Broad Form covers these animals against entrapment in stalls or other areas. For dairy products procedures, the coverage must be on the whole milking herd as opposed to simply one or a couple of cattle. 3rd event bodily injury, clean-up prices, as well as building damages brought on by a pollution occurrence are all covered under our special contamination insurance.

A Biased View of Prf Insurance

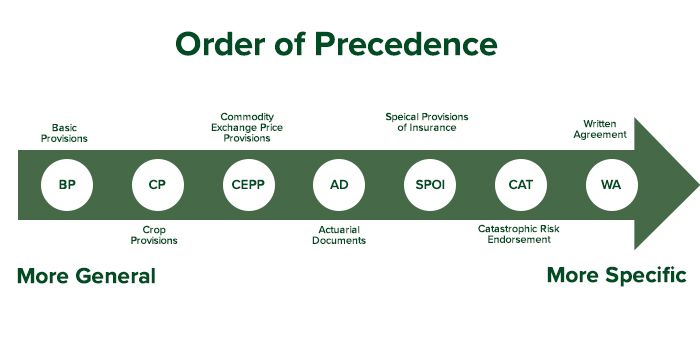

While each policy is special, most farm policies do share some typical terms or qualities. The following is a conversation discussing the a lot more basic components of a ranch insurance coverage policy. Understanding the different parts of a policy as well as the ideas of the plan can assist to much better evaluate a policy to determine if it provides adequate coverage for a farm.

The policy holds the insurance provider liable for paying the guaranteed for eligible claims. Furthermore, the contract requires the guaranteed to meet particular obligations such as the timely coverage of claims. Once the policy comes to be energetic, both the insurer as well as the guaranteed are legally bound to the regards to the policy.

Having actually all properties covered under one plan is typically cheaper than having one plan for the ranch possessions and an additional plan for non-farm protection. Significantly absent from the above checklist are cars. A different plan might be provided for the coverage of automobiles for both liability and also property loss.

In case of damages or devastation of a farm property because of a covered hazard, the insurer will pay at the very least some, but always all, of the value of the covered asset to the farm procedure. Standard Coverage. A plan that offers standard coverage is just mosting likely to cover the insured for called perils.

Prf Insurance Fundamentals Explained

Rather of recognizing the hazards covered, special coverage uses insurance coverage Continued to everything other than what is especially determined as an exemption. Unique coverage gives a lot more detailed protection since everything is consisted of unless excepted.

Special protection might include many exemptions. Unique protection will likely consist of an exception for vandalism in structures that have been uninhabited for 30 days. It is essential to know what exemptions are consisted of with unique protection. A plan may consist of one or even more of the different sorts of coverages.

It is essential to know what possessions are covered under which sort of coverage. Unique insurance coverage is best for the most extensive coverage, however specialcoverage is additionally much more costly than standard as well as wide coverage. Evaluating the added cost of unique coverage versus the benefit of detailed insurance coverage provided is an important analysis to be provided for each insurance plan.

Get in touch with an representative to discover even more concerning Agriculture insurance coverage.

Some Of Prf Insurance

As each farm is unique, has a tendency to be highly tailored, beginning at the minimum quantity of insurance coverage as well as getting more customized depending on the needs of your home or service. It is made use of to secure your farm investments, and not just protects your major ranch yet likewise your house. If farming is your full time profession, farm proprietor's insurance is Bonuses a smart financial investment.

This fundamental insurance needs to be tailored flawlessly to satisfy the requirements of your ranch. The good news is, an insurance agent will certainly be able to aid you identify what fits your farm! When thinking about if farm or ranch insurance coverage appropriates for you, we great site recommend taking any kind of extra frameworks on your land, income-earning livestock, and also any type of employees right into consideration.

Your farmhouse isn't the just high rate product you own, and also as a result of that, on-site tools such as tractors, trailers, and also others need to be factored in. This cost generally reduces as your equipment drops. For a basic ranch and ranch plan, the ordinary rate is determined based upon your place, procedures, asserts history, and more.

Farm products that have been planted are not covered by farm insurance and also rather are typically covered by a business insurance policy if the quantity of sales exceeds your incidental income limitation. No matter the number of preventative measures you take, crashes can still take place to also the most experienced farmers. If a pet were to run away the farm as well as cause a mishap, you would certainly be accountable for the accident as you are the animal's owner.

The Only Guide for Prf Insurance