Exactly How Medicare Supplement Can Improve Your Insurance Policy Coverage Today

As individuals browse the ins and outs of health care strategies and look for detailed protection, recognizing the subtleties of extra insurance policy ends up being significantly important. With an emphasis on bridging the spaces left by traditional Medicare strategies, these supplementary choices provide a tailored approach to conference certain needs.

The Fundamentals of Medicare Supplements

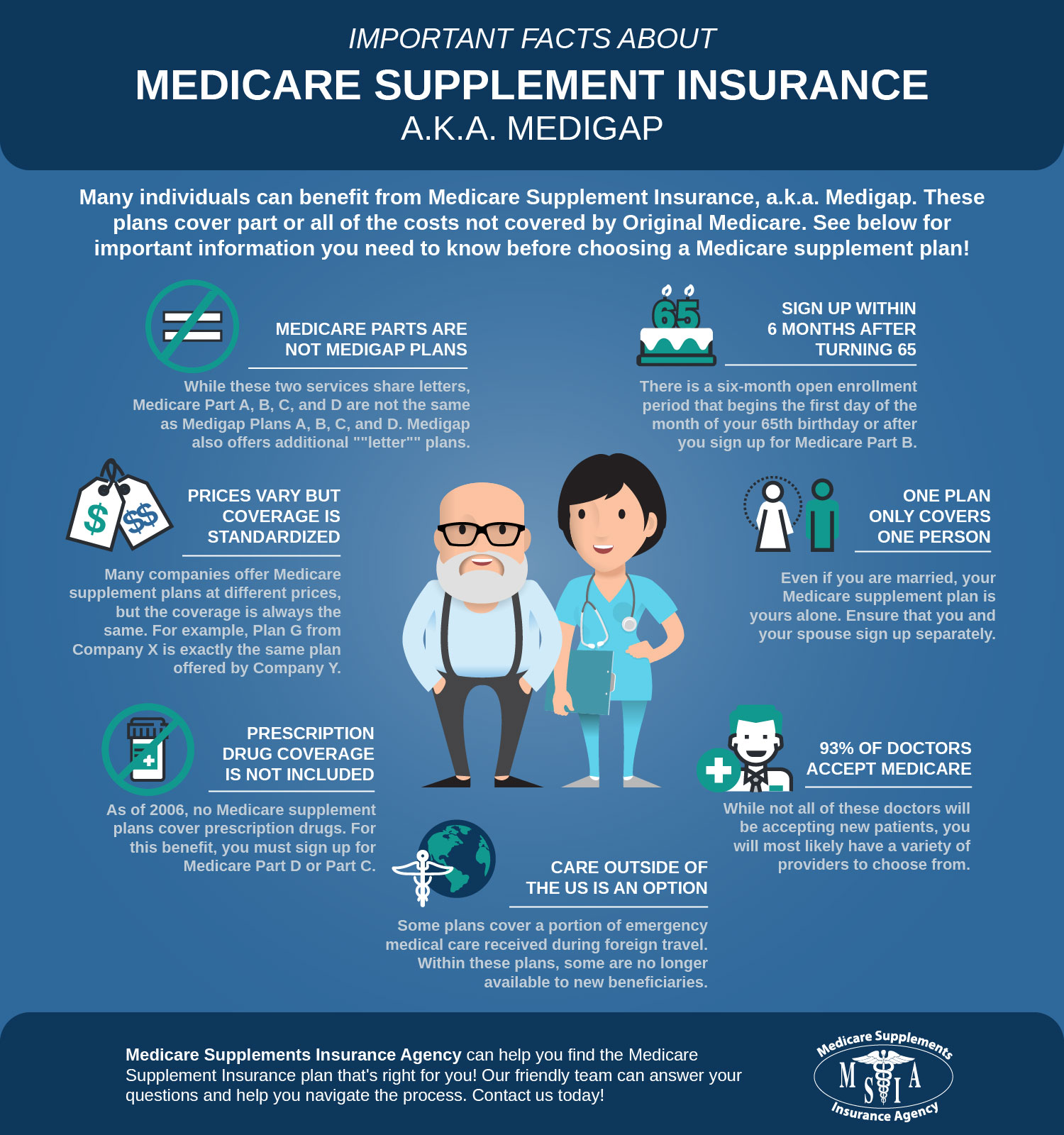

Medicare supplements, additionally called Medigap strategies, provide additional insurance coverage to load the spaces left by original Medicare. These supplemental plans are provided by exclusive insurance policy firms and are developed to cover expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Component A and Component B. It's important to keep in mind that Medigap plans can not be used as standalone plans yet job alongside initial Medicare.

One secret element of Medicare supplements is that they are standard throughout a lot of states, using the very same fundamental advantages no matter of the insurance coverage supplier. There are 10 different Medigap plans identified A via N, each providing a different level of protection. For circumstances, Strategy F is just one of one of the most thorough alternatives, covering mostly all out-of-pocket expenses, while various other strategies may use a lot more restricted protection at a reduced premium.

Understanding the fundamentals of Medicare supplements is crucial for individuals approaching Medicare eligibility that desire to improve their insurance coverage and minimize possible monetary burdens related to healthcare expenditures.

Recognizing Coverage Options

When considering Medicare Supplement plans, it is crucial to recognize the different coverage choices to make certain detailed insurance policy security. Medicare Supplement intends, likewise recognized as Medigap policies, are standard throughout most states and labeled with letters from A to N, each offering differing levels of coverage - Medicare Supplement plans near me. Furthermore, some strategies might provide insurance coverage for services not consisted of in Initial Medicare, such as emergency situation care during foreign traveling.

Advantages of Supplemental Plans

Furthermore, supplemental plans provide a wider range of protection alternatives, consisting of accessibility to health care companies that might not accept Medicare assignment. One more benefit of additional strategies is the capacity to travel with tranquility of mind, as some plans supply insurance coverage for emergency medical services while abroad. Overall, the benefits of additional plans add to a much more extensive and customized technique to health care coverage, ensuring that people can receive the care they require without encountering overwhelming financial problems.

Cost Considerations and Savings

Offered the economic security and more comprehensive coverage choices given by additional strategies, a crucial facet to take into consideration is the cost factors to consider and prospective cost savings they supply. While Medicare Supplement plans call for a month-to-month costs along with the typical Medicare Component B premium, the benefits of decreased out-of-pocket prices frequently outweigh the included expense. When evaluating the cost of additional strategies, it is important to compare premiums, deductibles, copayments, and coinsurance across various strategy types to establish the most economical alternative based upon individual medical care needs.

By picking go a Medicare Supplement strategy that covers a greater percentage of health care expenditures, people can decrease unexpected prices and budget more properly for clinical treatment. Eventually, investing in a Medicare Supplement plan can supply valuable monetary security and peace of mind for beneficiaries seeking comprehensive coverage.

Making the Right Selection

Picking the most suitable Medicare Supplement plan requires mindful consideration of individual healthcare demands and economic conditions. With a selection of strategies available, it is crucial to evaluate variables such as protection choices, premiums, out-of-pocket prices, carrier networks, and total worth. Recognizing your current wellness status and any type of awaited clinical requirements can guide you in selecting a strategy that uses comprehensive insurance coverage for services you may need. In addition, reviewing your budget constraints and comparing premium prices amongst various plans can aid make sure that you pick a plan original site that is cost effective in the long term.

Final Thought